New Zealand Withholding Tax

for Visiting Performers and Sportspeople

Issues to be considered

1. Each overseas (non-resident performer and sportsperson (individual or corporation) (the NR) is subject to Non-Resident Withholding Tax (NRWT), now referred to as a Schedular Payment, with respect to income derived from services provided in New Zealand.

2. Tax is required to be withheld by the payer (the promoter) and remitted to the New Zealand Inland Revenue Department (IRD) at the flat rate of 20% of the NR’s gross income.

Summary of overall tax position

3. However, due to New Zealand legislative changes in October, 2015 with respect to Tax ID registration regulations it is now not possible to file an income tax return in NZ unless the non-resident artist/corporation LLC/LLP has successfully opened a New Zealand bank account. Once an account is opened it is then possible to apply for an IRD number which, in turn, permits a tax return to be filed. Without an IRD number withholding tax at the rate of 20% of gross is now simply deducted at source and filing is not possible.

Further, depending upon the extent of the costs directly attributable to the New Zealand leg of a tour filing a return may produce a higher amount of tax payable because the IRD will not allow bigger ticket claims for management and business management commissions. Therefore, in the case of corporations i.e., the 28% tax on net income may often prove to exceed the 20% withholding tax on the gross fee.

4. If a non-resident corporation files an Income Tax Return it will pay tax at the flat rate of 28% of its net income.

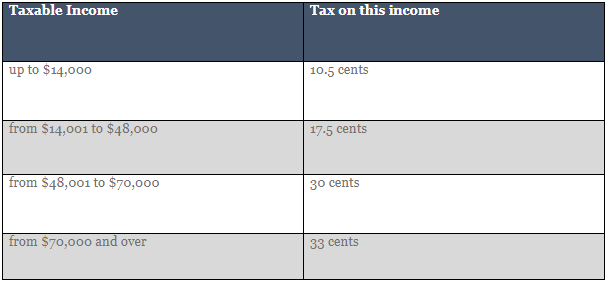

5. If a non-resident individual files an Income Tax Return he/she will pay tax at the following rates on his/her net income –

6. For tax residents of the United States, exemption under the USA/New Zealand Double Tax Agreement (DTA) may be applicable if the total fees earned (inclusive of per diems) are the equivalent of US$10,000 or less for each tax year ending 31 March. OTHER NEW ZEALAND DTAs DO NOT HAVE THE SAME DE MINIMIS RULE.

7. Goods and Services Tax (GST) (15%) is not charged on performance fees and the NR is not required to register as a GST payer. Similarly, GST cannot be recouped by the NR from local costs incurred unless it voluntarily registers as a GST payer. Such registration requires the NR to be issued with an IRD number which necessitates following the application process described in Point 3 above.

8. It is not incumbent upon the NR to file a New Zealand Income Tax Return. In this instance the 20% withholding tax retained and paid by the promoter will be the NR’s final tax. In these cases the IRD will issue a written acknowledgement of the tax paid (Contribution of Earnings) by the promoter so the NR may claim a foreign tax credit against its domestic taxes. In the event that an NR is eligible to file an Income Tax Return it may be filed at any time – it is not necessary to wait until the end of the New Zealand fiscal year.

9. It is not possible for the NR to apply for and obtain an advanced reduction of the withholding tax rate in New Zealand.

For further information or assistance in relation to the above, please do not hesitate to contact Michael Roseby of Artist Escrow Services, Melbourne.

Tel +61 3 9823 3366 Email msr@rosroy.com.au